APAC Biopharma Industry Insights: Trends, Opportunities, and Challenges

In the last 10 years, the Asia-Pacific (APAC) region has become a hotspot for clinical trials: the region contributed almost 50% of new clinical trial activity globally. The importance of APAC trials has also evolved, from the patients/sites being a contributor to address global patient enrollment issues to being a key player in global trials. This is driven by its large patient population, lower risk of competing trials, government support, pragmatic regulatory processes, lower cost of conducting trials, and strategic importance of Asian markets.

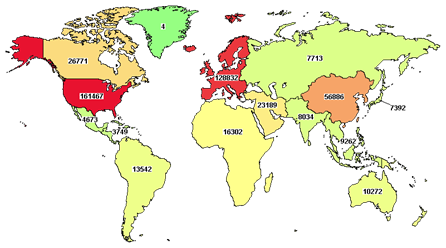

Figure 1: Number of Clinical Trials by Country/Region

Source: ClinicalTrials.gov database, sourced on April 14, 2023.

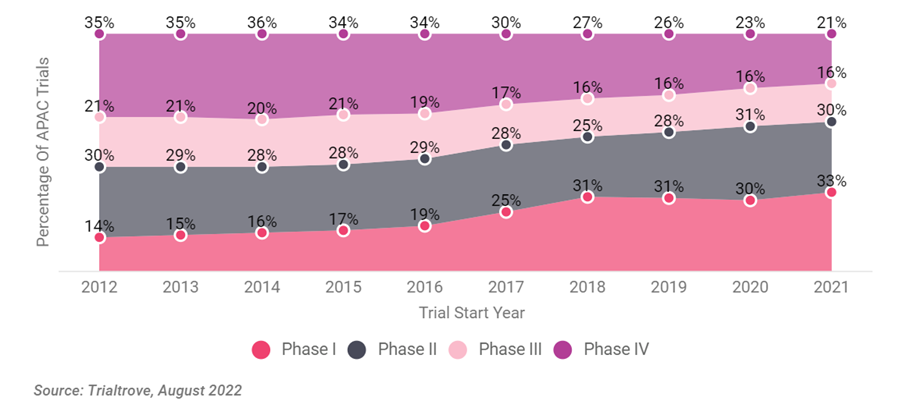

There has been a noted shift in research priorities in APAC clinical trials from late-stage trials (Phase III or Phase IV) to early-stage (Phase I and Phase II). Reports from Trialtrove 2022 indicate that the Phase I clinical trials in 2022 accounted for a third of clinical trial activities. Today, the top five locations for Phase I clinical trials in Asia are China, Australia, South Korea, Japan, and India, with China alone responsible for nearly 40%.

Figure 2: Shares of Phase I Trials in APAC (2012–2021)

Source: In Vivo Pharma Intelligence, “APAC As A Clinical Trial Powerhouse.”

Overall, the data suggest an increasing level of innovation within APAC, particularly in China and Korea. A healthy proportion of Phase I trials suggests that novel chemical or biological entities are being developed in the region, rather than multinational Phase III trials that satisfy global regulatory requirements, or indeed Phase IV studies of mature drugs.

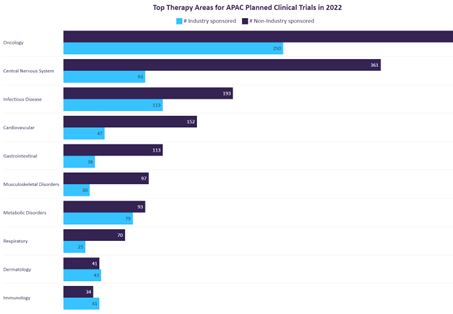

Figure 3: Top Therapy Areas for APAC Planned Clinical Trials in 2022

Source: GlobalData, Asia Pacific (APAC) Dominance in the Planned Clinical Trials for 2022.

Understanding planned clinical trials provides a cue on how the industry moves. As the biopharmaceutical industry advances, these APAC companies are facing the following challenges:

- Intense competition due to homogeneous products and new breakthrough points are required;

- The complexity of clinical trials continues to increase and if these trials are to be tested and verified using the traditional methods, the lifecycle will be relatively long with past success and practices no longer adequate predictors of future success;

- The need to identify commercially viable fields with the saturation of the oncology field. Identifying cures for presently incurable diseases, such as Alzheimer’s and epilepsy, rare diseases are indications that are evolving; and

- The growing demand for going global. Many of the biopharma companies in Asia, especially in China, are striving for significant impact on the global biopharma value chain. It is no longer an “in China for China only” scenario, with the innovative drugs only for the country. Companies such as Beigene and Legend are actively seeking commercial opportunities in global markets, particularly in the US, to offer lower-price alternatives to products from multinational companies.

Companies will need to explore adoption of innovative methodologies in clinical trial design, data management, and study execution to address the complexity of trials, the mitigation of risks, and the handling of quantum of data. Further, there is an increased focus on operationalizing decentralized trials to streamline trial processes, on the better use of wearable devices and sensors to collect patient health data, and on the integration of machine learning and artificial intelligence to manage large amounts of data.

There has also been an increasing trend of licensing of assets developed in China to global pharmaceutical companies, especially with cancer therapies. These APAC-based biopharma are partnering with global pharmaceutical companies to bring their early-stage assets to more advanced stages and clinical trials.

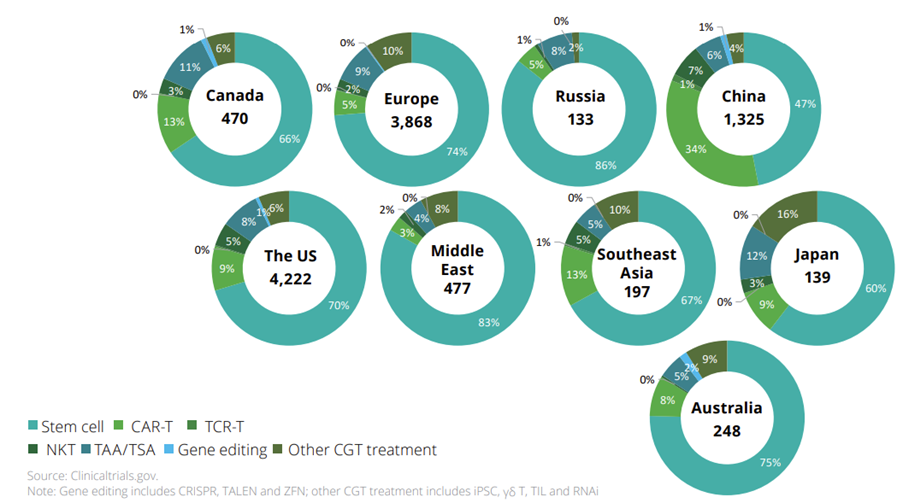

In the space of innovative products, there has been an increasing focus on cell gene therapies in the region. With more CAR-T treatments expected to be approved in 2023 and more IND applications submitted to the FDA, it is important to look at accelerating new CGT trials (Figure 4) and the adequacy of clinical evidence to justify the cost of products.

Figure 4: CGT Treatment-Related Clinical Trials by April 2021

Source: Deloitte, Outlook on Biopharma Innovation Trends in China, July 2021.

This will be a great opportunity and it is with this intent that Cytel is expanding into the Asia-Pacific region. With our on-the-ground capabilities in Singapore, China, Australia, and Japan, we are now equipped to handle the biometric activity of global and regional trials, especially for sponsors who are looking at tapping into the benefits of each region.

To help accelerate the innovation pace of the APAC biopharmaceutical industry and to seize development opportunities, we have taken the following strategies:

- Build a localized team, with presence in Shanghai, Beijing, and more cities in China, Japan, Australia, and Singapore. The local team will be able to act with urgency by working closely with the customers in the same time zone and by understanding the local culture. Further, this enables us to tap onto the talent pool in APAC, increasing the size and diversity of our talent resources in Cytel.

- Cultivate the quality biometrics offering in the industry and provide professional statistical software and research support that embraces the entire drug development process. We will continue to nurture the understandings of local markets, with a focus on small-to-mid-size biopharma and biotechnology companies and academic research institutions. We hope to accelerate their clinical trials, from pre-IND submission and protocol design to trial conduct, trial close-out, and commercialization.

- Promote our innovative offerings, beyond East® and East Bayes®, focusing on providing targeted services in specific Asia countries — across consulting and trial design, data management and biostatistics, real-world evidence (RWE), real-world data (RWD), health economics and outcomes research (HEOR), and data monitoring committees (DMC). By planning the right trial with the optimal trial design and integrating strategy and efficient statistical tactics, it will shorten the drug development cycle, increase the success rate of research, and reduce R&D costs.

- Collaborate with local partners to build a more coherent and seamless service for clinical research. To date, we have established MOU with LIDE (pre-clinical CRO), HLT (digital solution CRO), and Trial Informatics (Imaging CRO) in the region. We look forward to establishing more partnerships to help streamline the clinical trial execution.

APAC is a rapidly changing landscape with an abundance of opportunities as the region develops as an important drug development hub. Cytel aims to be a strategic partner with our customers and business partners in their journey from drug discovery to market approval. With our 35 years of rich experience in clinical trials, we have the capabilities to provide innovative solutions at all phases of drug development, assisting our customers to prove the value of their product.

Interested in learning more? Contact us!

Check out the recent news of Cytel in China:

- “Pharmaceutical Companies Grab Chinese Market Opportunities,” China Daily.

- “数字化”席卷生物医药领域 ‘AI+CRO’ 模式能否加速行业变革,” 21st Century News (With the Rapid Digitalization of the Biopharmaceutical Field, Can “AI+CRO” Model Accelerate Industry Change?)

Read more from Perspectives on Enquiry & Evidence:

Sorry no results please clear the filters and try again

Comparative Effectiveness: Methods and Techniques for Better Decision-Making

Data Challenges (and Solutions) for Externally Controlled Trials

Navigating Comparative Effectiveness in the Inflation Reduction Act: Methodological Approaches for Healthcare Challenges

If you'd like updates on our blog posts, sign up for email updates below.